PROGRAMME OVERVIEW

To support the growth of the Digital Economy and to increase the tax collection, the government intends to implement e-invoicing in stages starting from 1st August 2024 to enhance the efficiency of Malaysia’s Tax Administration.

The focus is on strengthening the digital services infrastructure and digitalizing the tax administration.

An e-invoice is a digital representation of a transaction between a supplier and a buyer that is generated, sent, received, and processed electronically over the internet.

OBJECTIVE

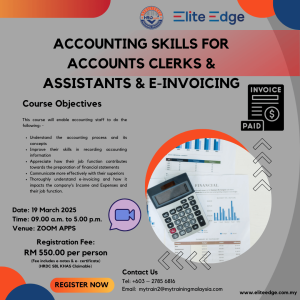

This course will enable participants to:

- Understand what is e-Invoicing

- Be aware of the timeline set by the Government

- Evaluate their current situation and take appropriate steps to get ready for e-Invoicing

- Understand how e-invoicing will impact each staff’s job functions

- Understanding the role of staff members especially in Accounting and IT in ensuring the smooth implementation of e-Invoicing

DELIVERY METHODOLOGY

Presentation, practical exercises, case study & Interactive discussions via zoom apps.