INTRODUCTION:

Companies registered in Malaysia are required to prepare statutory financial statements in accordance with the approved accounting standards issued by the Malaysian Accounting Standards Board (MASB).

MASB has two sets of approved accounting standards, namely:

• MASB approved accounting standards for entities other than private entities – Malaysian Financial Reporting Standards (MFRSs)

• MASB approved accounting standards for private entities – Malaysian Private Entities Reporting

Standard (MPERS) – effective for annual reporting periods beginning on or after 1 January 2016.

The MFRS Framework is to be applied by all entities other than private entities for annual periods beginning on or after 1 January 2012, with the exception of entities that are within the scope of MFRS 141 Agriculture (MFRS 141) and IC Interpretation 15 Agreements for Construction of Real Estate (IC 15), together with parents, significant investors and venturers of such entities (called ‘Transitioning Entities’). Transitioning Entities were allowed to defer adoption of the new MFRS Framework for an additional one year, which was subsequently extended a number of times pending completion of the IASB’s projects on revenue recognition and bearer plants. In completing these two projects, the IASB issued IFRS 15 Revenue from Contracts with Customers and Agriculture: Bearer Plants (Amendments to IAS 16 and IAS 41) during 2014 and the MASB subsequently announced on 2 September 2014 that the MFRS Framework will be mandatorily applied by Transitioning Entities for annual periods beginning on or after 1 January 2017, with earlier adoption permitted. This was later deferred to 1 January 2018.

On 14 February 2014, the MASB issued Malaysian Private Entities Reporting Standard (MPERS), which is effective for annual periods beginning on or after 1 January 2016. The MPERS applies to ‘private entities’, which are private companies as defined in the Malaysian Companies Act 1965 that are not required to prepare or lodge financial statements under laws administered by the Malaysian Securities Commission or Bank Negara Malaysia (the Malaysian Central Bank), and are not a subsidiary, associate, or jointly controlled by such an entity. Eligible entities have the choice of applying either the MPERS or Malaysian Financial Reporting Standards (MFRS).

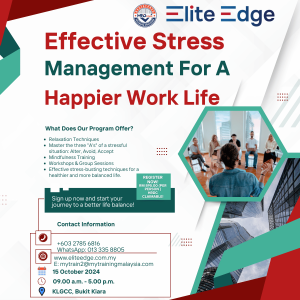

Download Training Brochure here